Sunbit: Access Needs & Boost Sales Learn How It Works!

In an era where financial constraints often dictate our choices, can accessible financing options truly empower individuals to manage everyday expenses without crippling debt? Sunbit, a financial technology company, is striving to revolutionize how people access essential services and products by offering flexible payment plans, potentially reshaping the landscape of personal finance.

Sunbit, headquartered at 10940 Wilshire Blvd, Suite 1850 & 1850A, Los Angeles, CA 90024, has emerged as a significant player in the fintech arena, focusing on providing financing solutions for everyday needs. The company's mission centers around making essential services and products more accessible by offering flexible payment options, thereby easing the financial burden on consumers. This approach directly addresses a growing need in a world where unexpected expenses can quickly derail financial stability.

The core of Sunbit's appeal lies in its user-friendly approach. Unlike traditional financing options, Sunbit boasts a streamlined approval process that avoids hard credit checks. This feature is particularly attractive to consumers wary of damaging their credit scores, providing an immediate sense of relief. Furthermore, the absence of fees and penalties underscores Sunbit's commitment to transparency and customer-centricity, distinguishing it from many other financial service providers. The platform also offers easy online management, allowing users to monitor their accounts and manage their payments with ease.

The company's success is reflected in its partnerships with top retailers and service centers. Sunbit has strategically aligned itself with merchants, enabling them to offer their customers a convenient way to manage expenses. The value proposition extends beyond customer convenience, as merchants experience boosted sales through the provision of flexible payment options. More than 3,000 service centers have already embraced Sunbit's technology, a testament to its effectiveness and appeal within the business community.

A key advantage of Sunbit's financing is its speed and accessibility. The quick approval process, combined with no impact on credit scores for checking eligibility, sets it apart from competitors. The process is designed to be fast and efficient, ensuring that consumers can access the necessary financing without unnecessary delays. This speed is particularly crucial in scenarios where immediate access to services or products is essential. For instance, when a car requires urgent repairs, waiting for traditional financing can be impractical.

Sunbit's financing solutions are facilitated through its partnership with Transportation Alliance Bank, Inc., (dba TAB Bank), which determines the qualifications and terms of credit. The financial technology company builds a bridge between consumers and essential services, and its role in managing the financial landscape extends beyond simple transactions. It is about offering individuals control over their finances, especially when faced with unforeseen or large expenses. Sunbit's goal is not only to facilitate transactions but to enhance the overall financial well-being of its users.

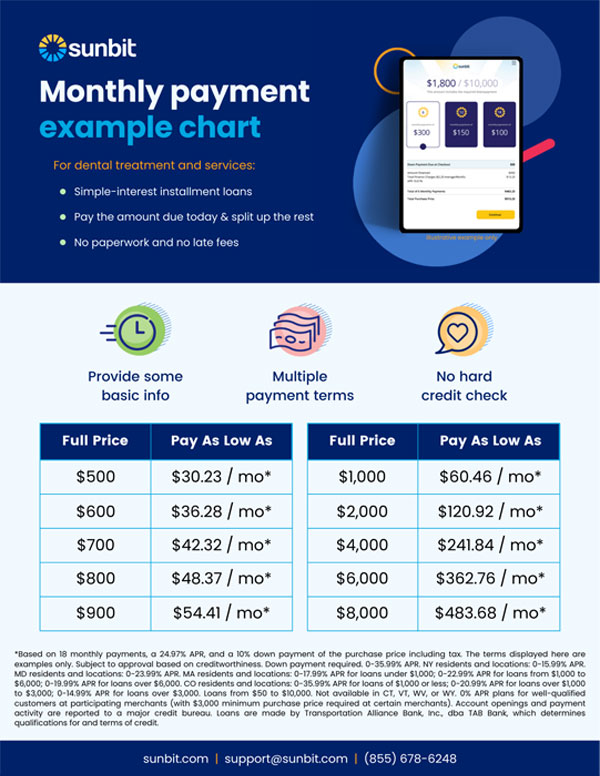

Consider the example of an individual needing a root canal. The upfront cost, often around $500 or more, can be a significant barrier for many. However, with Sunbit, this expense can be divided into manageable monthly payments, making the procedure accessible and removing the stress of a large, one-time payment. For someone facing unexpected car repairs, the ability to split the cost into manageable payments can be a financial lifeline, allowing them to keep their vehicle in good working order without causing financial strain.

The case studies reveal how Sunbit is used. For instance, Lifetime Vision and Eye Care has experienced a 178% increase in financing revenue, highlighting the impact on the revenue streams. Another user shared that the financial support for their car repairs and was a great help. They found the repayment plan manageable within their budget. Customer service is a key factor in Sunbit's service. It is consistently courteous and effective, and provides customer satisfaction.

Sunbit's Fast Lane feature is designed to streamline the payment process further, specifically within participating stores. This integration allows customers to manage their expenses more effectively. These strategic partnerships, and integrated payment systems, make it easier for customers to access the services they need.

The financial technology company addresses a significant gap in the market. In a 2020 survey by the Federal Reserve, it was revealed that only 64% of adult Americans could cover a $400 expense using cash, savings, or a credit card. The need for financing options, particularly for unexpected expenses, has never been more critical. As described by Jay Letwat, Executive Director of Business Development at Sunbit, there's a pressing need for patient financing. The product is not available in or to residents of Vermont, West Virginia, or Wyoming.

When using Sunbit, each time a purchase is financed a new agreement is entered into with the lender. The financing is subject to approval, based on creditworthiness, state of residence, and merchant location. While users may have several loans at a time, they will all be separate contracts with their own monthly payments. The Sunbit Card is subject to approval based on creditworthiness and state of residence.

The company's business model is based on creating value for both consumers and merchants. By offering accessible financing options, Sunbit empowers consumers to manage their expenses effectively while allowing merchants to increase sales and customer loyalty. The revenue model is based on providing these services, as they build the financial technology for everyday expenses. Sunbit has generated over $110,000 in revenue since launch, with $23,000 generated in the last two months alone. This rapid growth is evidence of the market's demand for flexible financing options.

Sunbits vision extends beyond its current offerings. The commitment to user-friendly technology and transparent practices positions it favorably within the rapidly evolving fintech landscape. The company is focused on continuous improvement and innovation. With its no-hard-credit-check, no-fee, and easy-to-manage approach, Sunbit is creating an accessible financing option. The company has partnered with over 3,000 service centers.

The integration with Sunbit is essential for merchants, as it allows them to offer access to a valuable financing solution that helps customers manage their expenses. This ensures customers receive necessary repairs while minimizing financial stress. By offering flexible payment plans, Sunbit is empowering thousands of merchants to earn more. Sunbit works to ensure that customers manage their expenses by offering flexible payment plans.

As the financial landscape continues to evolve, Sunbit is poised to play a pivotal role in shaping a more inclusive and accessible future for personal finance. The company is making a meaningful impact on the lives of millions of people, and supporting thousands of merchants nationwide, as well as revolutionizing access to the everyday needs.