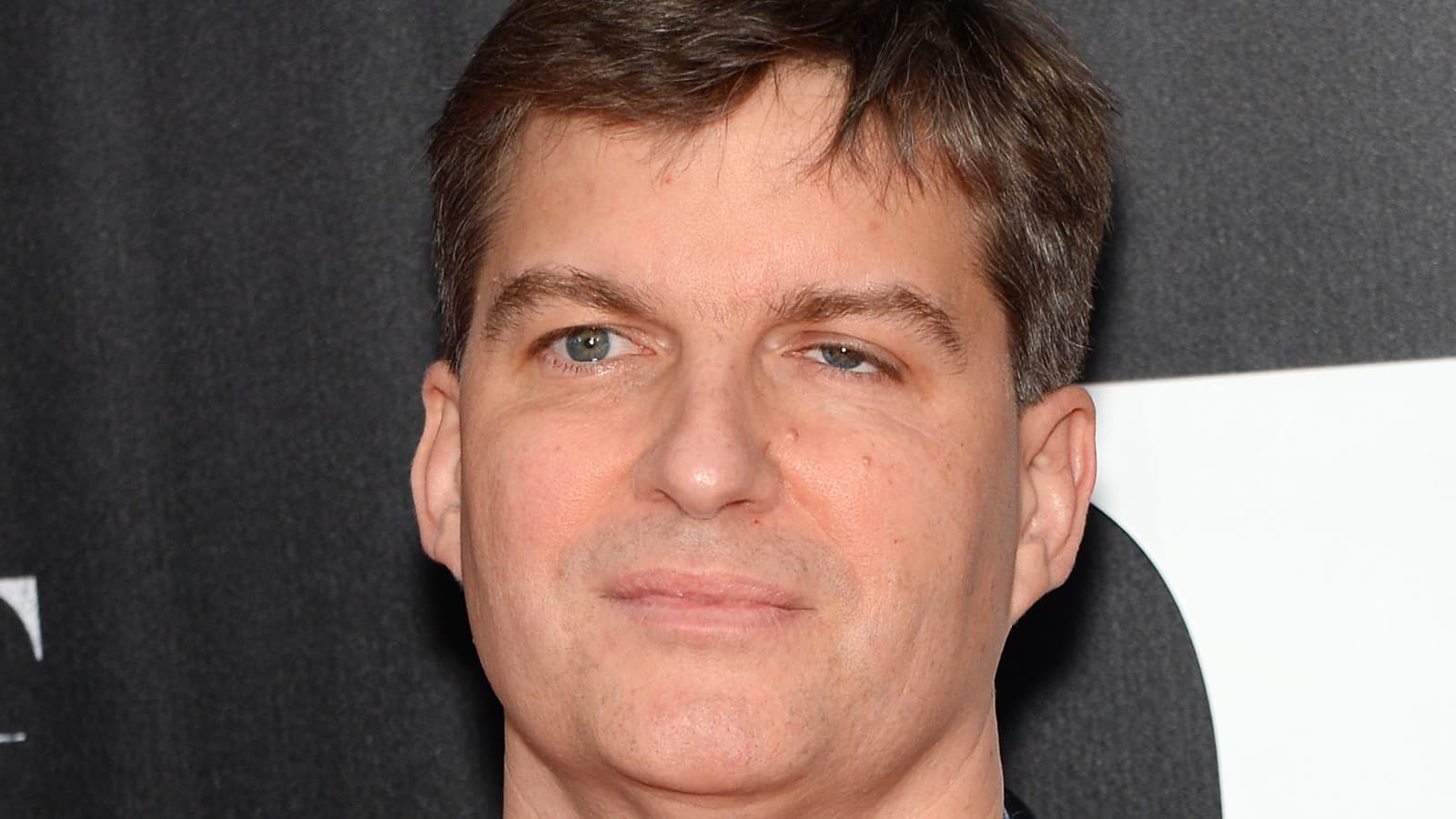

Michael Burry: Investing Secrets & Market Predictions In 2024

How does one consistently predict and profit from financial crises, becoming a legend in the process? Michael Burry, the American investor and hedge fund manager, has not only foreseen major market downturns but has also strategically positioned himself to capitalize on them, making him a figure of both fascination and influence in the financial world.

Burry's journey is a remarkable one, marked by astute observations, contrarian views, and a deep understanding of market dynamics. His early recognition of the subprime mortgage crisis of 2008, and his subsequent bet against the housing market, earned him widespread recognition and a place in financial history. His story, immortalized in the book and film "The Big Short," showcased his ability to see the cracks in the facade of the booming real estate market long before others did.

Born in San Jose, California, Burry's life has been shaped by challenges, including losing his left eye to cancer at age two. This early experience may have contributed to his unique perspective and his ability to see beyond the surface, focusing on underlying realities rather than fleeting trends. His medical background, as a physician, has also likely played a role, providing him with analytical skills and a methodical approach to problem-solving that he has applied to the world of finance. He has been known for his in-depth research.

| Attribute | Details |

|---|---|

| Full Name | Michael James Burry |

| Date of Birth | Unspecified (Born in San Jose, California) |

| Nationality | American |

| Profession | Investor, Hedge Fund Manager, Physician |

| Known For | Predicting and Profiting from the 2008 Subprime Mortgage Crisis, Involvement in GameStop Short Squeeze |

| Education | B.A. in Economics (UCLA), M.D. (Vanderbilt University School of Medicine) |

| Current Position | CEO of Scion Asset Management |

| Investment Philosophy | Value Investing, Margin of Safety, Contrarian Approach |

| Noteworthy Investments | Bet against the Housing Market (2008), Investments in Alibaba, Sprott Physical Gold Trust |

| Interesting Fact | Lost left eye to cancer at age two and wears a prosthetic eye |

| Reference | Wikipedia |

Burry's investment approach is deeply rooted in value investing principles, drawing inspiration from the teachings of Benjamin Graham and David Dodd, as detailed in their seminal work, "Security Analysis." His investment style is built upon a "margin of safety," seeking to buy assets at a significant discount to their intrinsic value. This cautious approach, which values a good understanding of the market. It has allowed him to identify opportunities that others have missed and to protect his investments during turbulent times.

Burry's recent portfolio moves offer insights into his current thinking. As of Q4 2024, his strategic recalibration is evident, with reductions in key Chinese tech holdings and new investments in the healthcare and consumer sectors. This shift suggests a cautious stance towards certain sectors and an anticipation of potential opportunities elsewhere. These decisions show his willingness to adapt to changing market conditions.

One notable aspect of Burry's recent investment activity is his increased exposure to gold. In the first quarter, he invested a substantial amount in Sprott Physical Gold Trust, indicating a hedge against potential economic uncertainties and inflation. This move aligns with his historical practice of seeking safe-haven assets during times of market volatility.

Burry's bet against the wall street crash is another major indicator. This shows his belief that market crash can occur in a near future, in which he is betting more than $1.6 billion on this particular outcome. This is the reason why he is well-known as one of the most celebrated risk-takers in Wall Street history.

Burry's influence extends beyond the financial world. The 2015 film "The Big Short" brought his story to a global audience, highlighting the intricacies of the 2008 financial crisis and the individuals who saw it coming. This exposure has made him a well-known figure, and his actions are closely watched by investors worldwide.

Alibaba (NYSE: BABA) has been a significant component of Burry's portfolio. While he reduced his position by 25% in Q4, it remains his largest holding. This suggests that he still sees value in the company, despite some concerns. Furthermore, his holdings in Alibaba were worth $10.9 million as of the start of the 2025 trade war, assuming his holdings remained level since December 31, 2024.

Burry's contrarian approach, built upon a strong foundation of research and analysis, has allowed him to anticipate market movements and to profit from them. His ability to identify risks and opportunities before others is a hallmark of his success. His investment decisions are closely watched by investors around the world, as they seek to understand market trends and anticipate future developments.

Burry is not one to shy away from controversy or unpopular opinions. His willingness to go against the grain has earned him both admiration and criticism, but his track record speaks for itself. He is a reminder that independent thinking, diligent research, and a long-term perspective are crucial in the world of investing.

In a world dominated by short-term thinking and market hype, Michael Burry stands out as a voice of reason, a strategist with a long-term vision. His ability to identify risks and opportunities has made him one of the most respected figures in the financial world.

The investor's journey reflects the complex interplay of individual talent, market dynamics, and the unpredictable nature of financial markets. His focus on "a margin of safety" and his ability to think independently have allowed him to navigate these challenges successfully.

It's worth noting that Burry's successes haven't come without challenges. His career has seen its share of ups and downs, yet he has consistently demonstrated resilience and a determination to stay true to his investment philosophy. This ability to adapt and learn from experience is an essential trait for success in finance.

The "Big Short" investor has built his investment style on Benjamin Graham's and David Dodd's 1934 book "Security Analysis," the core text for value investing. This book says, "all my stock picking is 100% based on the concept of a margin of safety. It is a testament to his enduring value.

While the future of the market remains uncertain, Michael Burry's strategies and experiences offer valuable insights for investors of all levels. His emphasis on fundamentals, risk management, and a long-term perspective provides a framework for navigating the challenges of the financial world.

In the realm of high finance, where fortunes can be made and lost in the blink of an eye, Michael Burry stands out as a figure of remarkable consistency and unwavering conviction. His story is one of sharp insights, contrarian views, and the courage to act on them a story that continues to unfold.

His strategic moves, particularly his recent shifts in portfolio composition, reflect a keen understanding of the shifting economic landscape. The choices he is making today will likely shape the market environment for years to come.

Michael Burry's influence extends beyond mere financial gains; his actions send a message about the importance of informed decision-making, thorough research, and the potential rewards of bucking the trend. In a world of constant information, his story continues to inspire and offer valuable lessons for anyone seeking to navigate the complexities of the financial world.

The movie "The Big Short" made his name famous throughout the world, which made him well-known for shorting the stock market. His medical background has further enhanced his abilities.